According to recent data, 40% of Americans keep $500 or less in their checking account, and only a smaller portion maintain higher balances — meaning that having more than $1,000 already puts you ahead of many households.

The average checking account balance in the U.S. is about $16,891, but the median (middle) balance is only around $2,800, showing that a large share of people have much less — and that your $1,000 balance is a meaningful buffer for many.

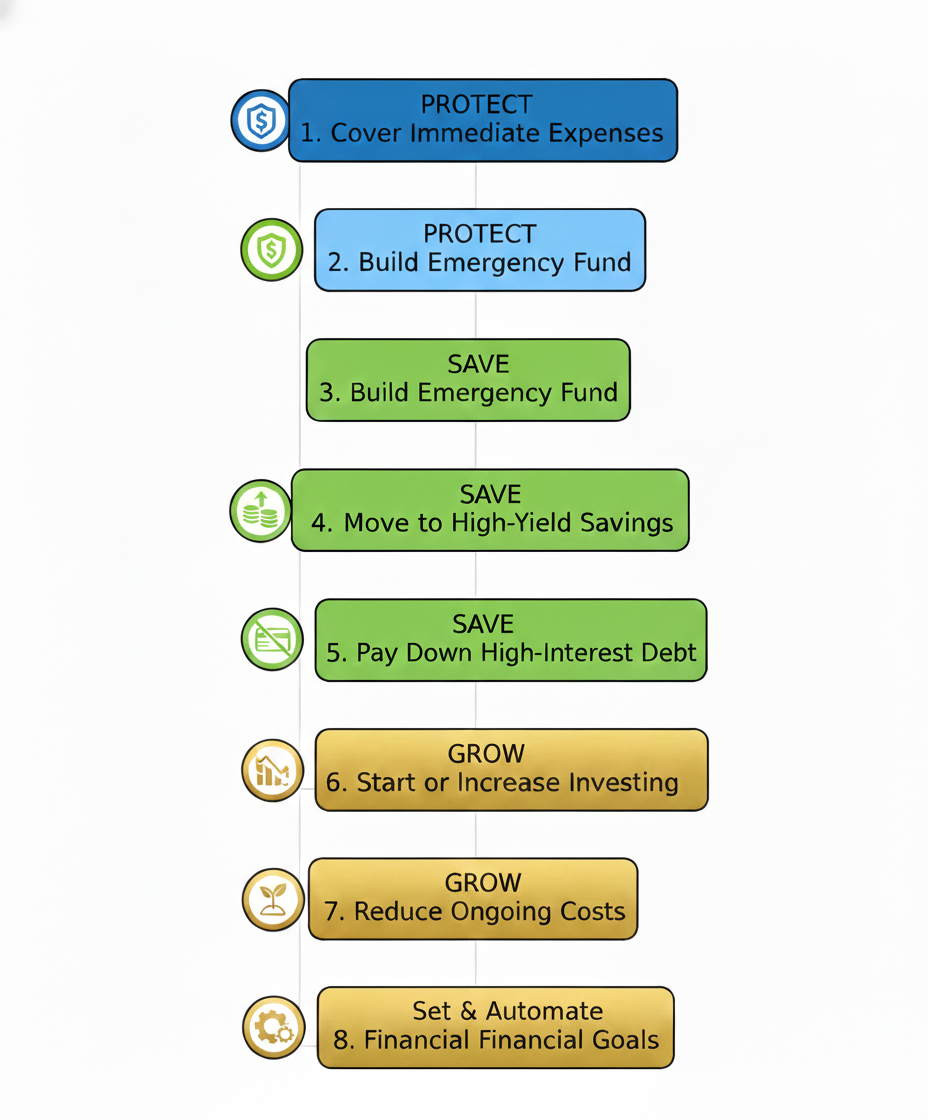

Seeing more than $1,000 in your checking account can feel like a financial milestone — a sign of progress, stability, and breathing room. But leaving that money idle in a low-interest account means you’re likely not using it to its full potential. Instead, there are strategic steps to take that strengthen your financial foundation and help you grow your wealth over time.

Here are 7 smart moves to make once you’ve got a surplus of $1,000 in checking — all backed by expert recommendations and real-world strategies.

1. Cover Your Immediate Expenses and Bills First

Before you decide where to move your money, ensure that your monthly living expenses are covered. Experts generally advise keeping enough in checking to cover at least one to two months of bills, including rent, utilities, groceries, and other essentials. If $1,000 doesn’t quite cover that yet, it’s okay to leave it where it is until your monthly budget is secure.

Without this buffer, moving surplus funds to long-term goals could leave you scrambling if unexpected charges hit.

2. Build or Strengthen Your Emergency Fund

One of the most important next steps is to create or grow your emergency fund — a separate savings pool designed to cover unforeseen expenses like sudden medical bills, car repairs, or job loss. Financial advisors often recommend saving enough to cover three to six months of essential expenses.

Instead of leaving all excess money in checking (where it earns little to no interest), consider transferring a portion to a high-yield savings account or a dedicated emergency fund account. The money remains accessible but starts working harder for you.

To avoid the temptation of spending it, the Consumer Financial Protection Bureau suggests moving this money to a separate account and even automating contributions so you build consistency without effort.

3. Move Some Funds to a High-Yield Savings Account

A checking account is convenient for everyday transactions, but it’s not designed for savings growth. High-yield savings accounts (HYSA) often pay significantly higher interest rates than standard savings or checking accounts, meaning your money grows more over time. Some financial platforms even offer partner banks with APYs close to 3–4% or more.

This move still keeps your funds liquid (easy to access when needed) while earning you a return that outpaces inflation.

4. Pay Down High-Interest Debt

If you carry high-interest debt — like credit card balances or personal loans — using part of your surplus to make extra payments can be one of the best financial moves you can make. Interest on such debts often far exceeds what you’d earn in a savings or investment account.

This step isn’t just about eliminating debt; it’s about reducing the amount you pay over time, freeing up future income for investing or saving.

5. Start or Increase Investing — Even With Small Amounts

Once essentials and emergency funds are in place, consider investing your excess money. You don’t need thousands to start — many platforms let you begin with small contributions. For example, apps like Stash allow fractional investing for as little as a dollar, making it possible to buy partial shares of companies like Amazon or Google and start building wealth early.

Even modest, regular investing over time can take advantage of compound growth, where earnings generate further earnings. This is often described as one of the fundamental pathways to building lasting wealth.

6. Shop Around to Reduce Ongoing Costs

Another smart use of a $1,000 checking surplus is to optimize your recurring expenses. Things like insurance, bank fees, and subscription services can silently drain your money if left unchecked.

For instance:

-

Comparing car insurance quotes could save you up to around $996 per year through services that compare multiple providers.

-

Switching to banks that offer lower fees or reimburse ATM charges can prevent unnecessary losses — especially as average fees like overdraft charges can be steep.

Reducing these costs keeps more money in your pocket every month.

7. Set Financial Goals and Budget Intentionally

Having more than $1,000 can be a signal to step back and set bigger financial targets. Whether it’s saving for a down payment, investing in education, or purchasing a home, defining clear goals helps you allocate money purposefully.

One proven, simple method for budgeting is the 50/30/20 rule, where 50% of income goes to needs, 30% to wants, and 20% to savings or debt repayment.

By planning how you want your finances to work together — not just sitting in one account — you make intentional moves that align with your long-term security and growth.

Bonus Tip: Automate Smart Money Moves

Automation is a financial hack recommended by experts: have savings, investment contributions, or debt payments transfer automatically as soon as you get paid. This “pay yourself first” strategy removes the temptation to spend first and save later, which is often less successful.

For example, your bank or financial app can automatically move a set amount each payday into savings or investment accounts, ensuring you stay consistent without thinking about it.

Having more than $1,000 in your checking account is a great start!

Having more than $1,000 in your checking account is a great start — but letting that money sit idle is like having an engine and never putting it in gear. By following these seven moves, you turn a simple surplus into a foundation for financial strength.

Start with stability: cover expenses and build your emergency fund. Then boost your money’s potential through savings, investing, and smart cost-cutting. With intentional planning, that $1,000 becomes more than a buffer — it becomes the start of real financial progress.